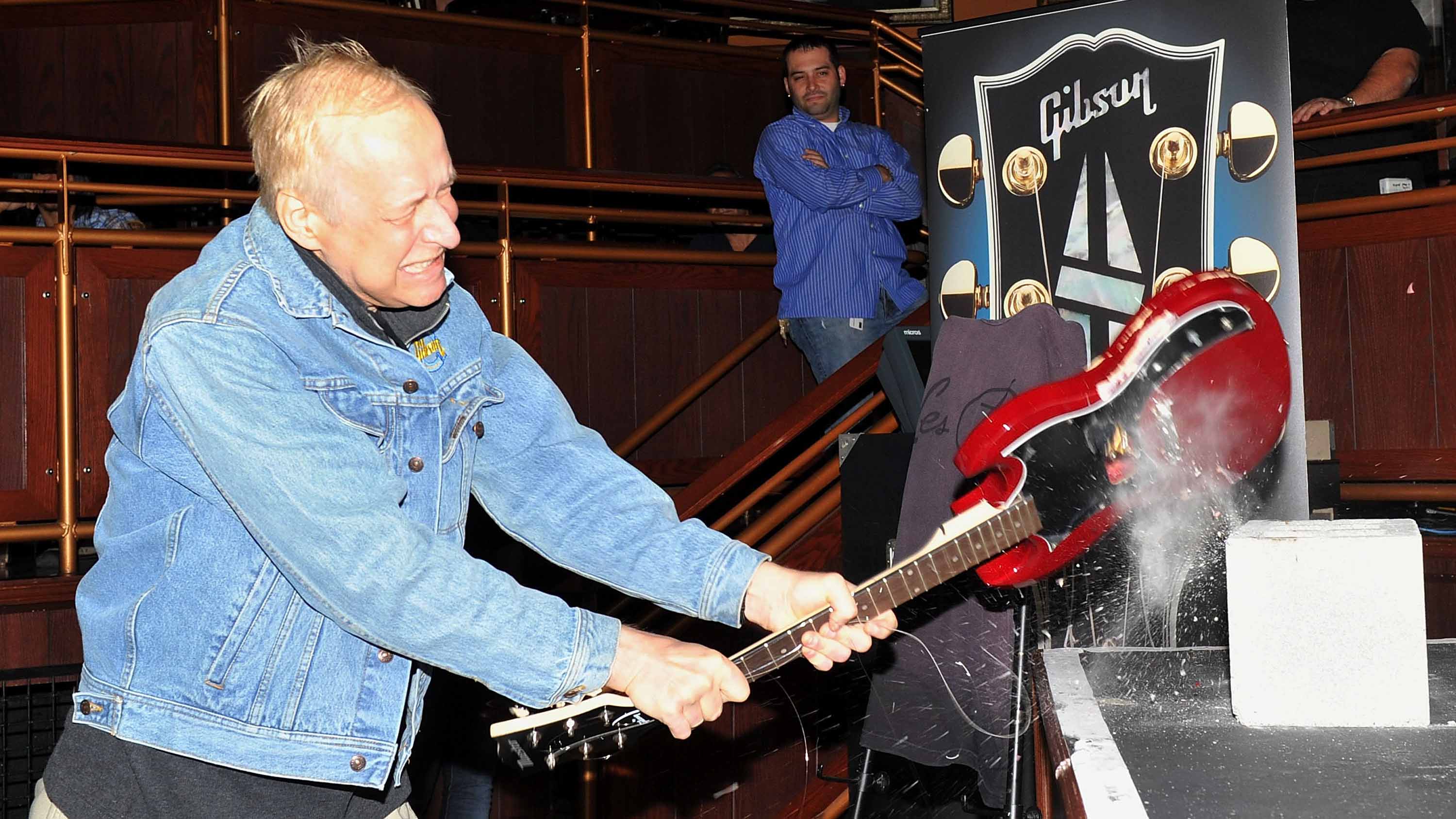

Gibson CEO Henry Juszkiewicz: “My dream was to be the Nike of music lifestyle… I have to cut back on that ambition, frankly”

Troubled guitar giant’s potential $560 million debt due this summer

Henry Juszkiewicz, CEO at struggling guitar company Gibson, has conceded his strategy to expand Gibson Brands hasn’t exactly gone to plan.

In a report from the Los Angeles Times, Juszkiewicz admitted, “My dream was to be the Nike of music lifestyle. At this point, I have to cut back on that ambition, frankly.”

The article also fans the flames of rumours that investors want Juszkiewicz out, while providing a reminder that up to $560 million of debt is due in the summer.

Charting the troubled guitar giant's decline and how it can rise once more

A series of damning quotes also feature, including Nashville-based Gruhn Guitars owner George Gruhn, who states, “You have to eat so much garbage in order to be a Gibson dealer that it's not worth it.”

Juszkiewicz has previously pinned the blame for the company’s financial troubles on “problems with the guitar retail industry” and “purists”, although he has now acknowledged the company’s hit-and-miss acquisitions, telling the LA Times, “We got sort of a grab bag full of stuff, and some of it really did make sense, but some of it was very unprofitable.”

Recent sell-offs include Cakewalk music software, which was recently purchased by BandLab, and Gibson’s iconic Memphis factory, which has now been sold to private equity firms Somera Road and Tricera Capital for $14.1 million.

The guitar giant’s current strategy is to “focus its Philips brand consumer audio business on those products that have greater growth potential” - its audio brand roster includes KRK Systems, TASCAM, Cerwin-Vega!, Stanton, Onkyo, Integra, TEAC, TASCAM Professional Software, and Esoteric.

Want all the hottest music and gear news, reviews, deals, features and more, direct to your inbox? Sign up here.

Mike has been Editor-in-Chief of GuitarWorld.com since 2019, and an offset fiend and recovering pedal addict for far longer. He has a master's degree in journalism from Cardiff University, and 15 years' experience writing and editing for guitar publications including MusicRadar, Total Guitar and Guitarist, as well as 20 years of recording and live experience in original and function bands. During his career, he has interviewed the likes of John Frusciante, Chris Cornell, Tom Morello, Matt Bellamy, Kirk Hammett, Jerry Cantrell, Joe Satriani, Tom DeLonge, Radiohead's Ed O'Brien, Polyphia, Tosin Abasi, Yvette Young and many more. His writing also appears in the The Cambridge Companion to the Electric Guitar. In his free time, you'll find him making progressive instrumental rock as Maebe.